The Ascension of a Thoughtful Value Investor

Any information provided here should be viewed as either my opinion or a description of how I do/would do things. In no way am I giving investment advice (please see the disclaimer).

Two things will be discussed in this post (both are interrelated):

- More about my journey to becoming a value investor

- My thoughts on what approach should be used to invest one’s capital (higher level view)

As I indicated in a previous post, my long journey to value investing commenced a while ago, but there were several distractions along the way – the reason why this website is named “Value Investing Odyssey”. I remember buying Seth Klarman’s Margin of Safety in 1992 (this turns out to be one of the best investments I ever made on a returns basis: I paid $25 for the book and I have seen it sell for over $1,500 online). Furthermore I was unemployed and broke in 1992, so it was also bought using leverage (credit card debt). Smart to have bought the book, dumb not to have read it back then (and to have used a credit card for a “want” and not a “need” at the time).

Sometime between 2005 and 2008 I remember hearing or reading some Warren Buffett quotes:

“If you know what you own, you will be fine” and “Risk comes from not knowing what you’re doing”

– Warren Buffett

At that time I was following the advice of several investment newsletters and buying individual stocks without doing any real analysis of my own. I then read Joel Greenblatt’s The Little Book That Beats the Market. In the book Joel offers the following to an individual investor who wants to invest in individual stocks but has neither the knowledge nor experience:

“Choosing individual stocks without any idea of what you’re looking for is like running through a dynamite factory with a burning match. You may live, but you’re still an idiot.”

– Joel Greenblatt

I realized I was one of those idiots (and I laughed, which was better than crying)! Thank you Joel! For your invaluable prompting me to get on the right track, I would be more than happy to go sailing with you.

The Intelligent Investor by Benjamin Graham suggests the endeavor of investing in individual equities should be treated as a business (one that buys partial ownership of other businesses):

“Yet every corporate security may best be viewed, in the first instance, as an ownership interest in, or a claim against, a specific business enterprise. And if a person sets out to make profits from security purchases and sales, he is embarking on a business venture of his own, which must be run in accordance with accepted business principles if it is to have a chance of success. The first and most obvious of these principles is, “Know what you are doing – Know your business.” For the investor this means: Do not try to make “business profits” out of securities – that is, returns in excess of normal interest and dividend income – unless you know as much about security values as you would need to know about the value of merchandise that you proposed to manufacture or deal in.”

So all this brought me to thinking about how I should go about investing and over time it evolved. I developed the following mental mapping (which was mostly in my head until I started drawing it on paper a few weeks ago).

Definitions of descriptions in above matrix

- Concentrated (Quadrant 1) means a portfolio of say 5 to 15 individual equity securities.

“In short, for the few who have the ability, knowledge, and time to predict normal earnings and evaluate individual stocks, owning less can actually be more—more profits, more safety . . . and more fun!”

– Joel Greenblatt

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

— Warren Buffett

- Outsource (Quadrant 2) means hiring a knowledgeable asset manager who you can trust and who is capable of investing in a concentrated portfolio. The key here is you need to have the knowledge to know when you are dealing with a good money manager before you give them any of your money to invest.

- Passive (Quadrant 3) means investing in low cost passive index funds.

- Diversified (Quadrant 4) means investing in active equity mutual funds or a diversified portfolio of equities by following the advice of a trusted source.

Back in the 2005 to 2008 time-frame I was mostly operating in what I call “Quadrant 4” and working full time as an Electrical Engineer, which limited the time I could devote to investing. Both my “investing experience & knowledge” and “available time & personal drive” dictated I should have been in “Quadrant 3”, so I decided I wanted and needed to know what I was doing so I could invest in individual equities on my own. This prompted me to start reading more about investing and increasingly warming up to the value investing approach (but how to actually do it was still a mystery even though I understood and agreed with the principles).

Today, I think an investor exposes themselves to tremendous risk when operating in the wrong quadrant as I had been.

I also think Buffett, Graham, Greenblatt and Klarman would all agree anyone operating in Quadrant 1 or 2, without having the necessary knowledge and experience is likely asking for trouble.

The Intelligent Investor by Benjamin Graham offers the following, which is very appropriate for Quadrant 2:

“A second business principle: “Do not let anyone else run your business, unless (1) you can supervise his performance with adequate care and comprehension or (2) you have unusually strong reasons for placing implicit confidence in his integrity and ability. For the investor this rule should determine the conditions under which he will permit someone else to decide what is done with his money.”

“I recommend that you adopt a value-investment philosophy and either find an investment professional with a record of value-investment success or commit the requisite time and attention to investing on your own.”

– Seth Klarman

I also think Buffett, Graham, Greenblatt and Klarman would all agree anyone operating in Quadrant 1 or 4, without having the available time and personal drive is likely asking for trouble. Some may argue Greenblatt’s “magic formula” is diversified and does not require a lot of time. While that is true, his strategy would require a high level of personal drive and belongs in Quadrant 4.

“Given the vast amount of information available for review and analysis and the complexity of the investment task, a part-time or sporadic effort by an individual investor has little chance of achieving long-term success. It is not necessary, or even desirable, to be a professional investor, but a significant, ongoing commitment of time is a prerequisite. Individuals who cannot devote substantial time to their own investment activities have three alternatives: mutual funds, discretionary stockbrokers, or money managers.”

– Seth Klarman

It is very important to understand the context of quotes made by various famous investors otherwise it leads to confusion or an erroneous belief that the person has changed their mind or is inconsistent. The best example of this is Warren Buffett. On some occasions he recommends a concentrated portfolio of individual equities and on other occasions he recommends passive index funds. Has Warren gone mad? No! When he discusses passive index funds he is talking about investors who upon a rational appraisal belong in Quadrant 3. When he talks about a concentrated portfolio he is assuming the investor has both the knowledge and time (remember Graham was Buffett’s mentor and The Intelligent Investor is one of his favorite books).

How I moved to “Quadrant 1” and am continuing to move deeper into it…

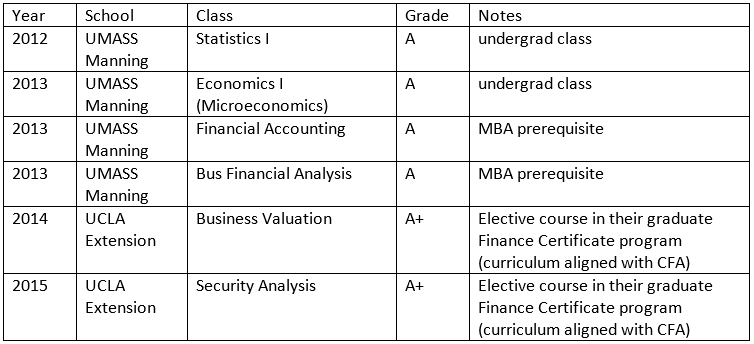

In 2012 I started going back to school to learn what I needed to know (initially thinking I should get an MBA). However, there are (or back then there were) very few AACSB accredited business schools that would allow you to directly enroll in an MBA program without taking several prerequisite courses. I also didn’t want to spend too much money either (I wasn’t doing this for career reasons – I just wanted to learn how to invest). Along the way I decided an MBA might not be the thing I needed because I was not interested in joining the corporate world as a manager. By year end 2013, I decided I was going to concentrate on taking classes more relevant to investing. The progression of classes taken in this time-frame appears in the table below.

I consider myself very fortunate to have taken a modern security analysis class from a professor who liked the value approach (the ability to learn value investing alongside modern portfolio theory was very beneficial).

UCLA Security Analysis Course Description:

“This updated, rigorous, and exciting course examines companies and industries using a fundamental and timeless classical approach first developed by Benjamin Graham in 1934. Instruction focuses on the examination of equities and bonds by taking an in-depth look at the financial statements concentrated on the income statement, balance sheet, cash flow statement, and financial notes. The tools and techniques used are as relevant today as they were when Graham first developed the basis for value investing. Through case study analysis of actual companies, students learn the tenets of value investing, ratio analysis, and industry analysis. This course draws on subsequent editions of Graham’s classic, Security Analysis, considered by many professional investors to be the best book written on fundamental analysis.”

One of the requirements for the class was to write a case study and there were 10 to choose from. Without hesitation I chose the UVA Darden case study titled “WARREN E. BUFFETT, 1995” which was written by Professor Robert F. Bruner in 1996 (after Berkshire Hathaway acquired GEICO). This allowed me to get an in depth look at three of the best investors in stock market history: Benjamin Graham. Warren Buffet and Lou Simpson (I have shared my paper here https://www.linkedin.com/pulse/warren-buffett-case-study-john-yannone/ ). By the time I finished the class I knew all I wanted to do was be a value investor and operate in what I call “Quadrant 1”.

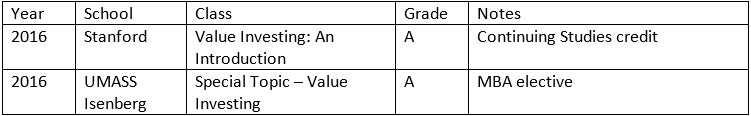

While I learned a lot in all of the above classes, I felt I still needed to learn more specifically about value investing. I did some searching and found very few schools offering value investing classes. Of the few I found, I took both of the following classes in 2016.

The Stanford class was taught by Kenneth Marshall using material and his Value Investing Model that he would later publish in his book Good Stocks Cheap (which I highly recommend). In order to receive a grade I had to write a recommendation to buy a certain listed equity of my choosing and demonstrate that I understood the business, that it had performed well in the past, had good prospects for the future and was undervalued (I have shared my paper here https://www.linkedin.com/pulse/value-analysis-westlake-chemical-john-yannone/ ).

The UMASS class was taught by Anurag Sharma using material he developed and three books.

- Security Analysis by Graham and Dodd (which I highly recommend)

- Book of Value: the Fine Art of Investing Wisely by Anurag Sharma (which I highly recommend)

- A Short History of Financial Euphoria by John Kenneth Galbraith

Unfortunately the paper I wrote for this class was a group paper so I will not be sharing it. However, towards the end of Professor Sharma’s class, he required students to write a one page self-reflection paper (I have shared my paper here https://www.linkedin.com/pulse/what-value-investing-john-yannone/ ) The final paragraph reflected on what more I would like to learn about value investing and related materials:

“Many ideas put forth by Benjamin Graham were later refined by Warren Buffett and others, so another important aspect of value investing is the act of self-reflection, continual learning and striving to be better. We also learned that the refutation and disconfirmation framework should be used and refined until it is no longer helpful at pointing us in the right direction. In this light, I would like to expand my knowledge of the qualitative analysis skills from the diligence chapters of the book. This includes learning new skills for assessing economics of companies and determining durability of economic advantages. To help in this learning, I plan to take a class in corporate strategy. I also plan to continue reading books written by more successful value investors.”

It turns out I actually took several classes in business strategy in 2017 (and I still consider myself a student).

In 2017 I also participated in one 1-day and two 10-week Advanced Value Investing workshops hosted by Kenneth Marshall (More about what I did in 2017 can be found here https://www.linkedin.com/pulse/what-value-investing-revisited-john-yannone/ ).

I did more self-reflection throughout 2017 deciding what would make me happier for the rest of my life using “less is more” as a guiding principle. I ultimately decided to focus on staying healthy, spending more time with family and friends, hiking, continually learning business/finance skills and searching for undervalued public equities as a value investor. So, the journey continues…